Capital Market Transactions Include Which of the Following Quizlet

Capital markets channel the wealth of savers to those who can put it to long-term productive use such as companies or governments making long-term investments. Common stock of a public corporation b.

Underwriting Learn More About The Capital Raising Process

Money markets are considered low risk.

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

. The capital market involves trading of bonds and stocks. 55 Capital market transactions include which of the following. 1 Answer to Capital market transactions include which of the following.

It is a place where the trading of financial instruments is done for the first time also known as Initial Public Offer IPO. A company that issues a round of stock or a new bond places it in the primary market for sale directly to. Capital market secondary market open market spot market.

Treasury bonds trade in the capital market. The maturity period of securities in the Capital Market is more than one year or irredeemable ie. AIn the secondary market all sales proceeds go to the issuer.

Capital markets deal only with common stocks and other equity securities. Capital markets channel savings and investment between suppliers of capital such as. Thus since it is a municipal bond that is involved here it is clear that its purchase happens in the capital market.

All the transactions that occur in the markets in your countrys economy. Rather it represents a loose collection of dealers who trade stocks electronically. Typical buyers of bonds include all of the following EXCEPT ________.

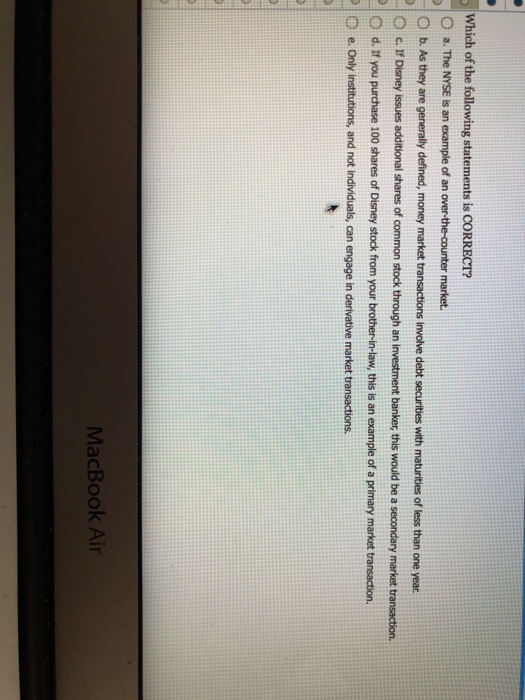

Capital market is a market where buyers and sellers engage in trade of financial securities like bonds stocks etc. Which of the following statements is correct. The buyingselling is undertaken by participants such as individuals and institutions.

The primary market is a new issue market that mainly deals with the issues of new securities. Capital market transactions only include preferred stock and common stock transactions. It is of two types primary market Primary Market The primary market is where debt-based equity-based or any other asset-based securities are created underwritten and sold off to investors.

For primary and secondary markets which of the following is TRUE. The capital market is roughly divided into a primary market and a secondary market. BIn the primary market securities are sold to the public and the issuer receives the sale proceeds.

The total amount of money in each countrys economy. Securities that are traded in Capital Market include stocks bonds debentures etc. Capital market transactions only include preferred stock and common stock transactions.

The capital market trades in most bonds stocks and other instruments either backed by equity or redeemable in more than one year. The total amount of investment opportunities within each country. Capital Market can be divided into Primary Market and the Secondary Market.

A within their own countries. Start Your Free Investment Banking Course. Any security that is purchased from a brokerage firm that is well capitalized d.

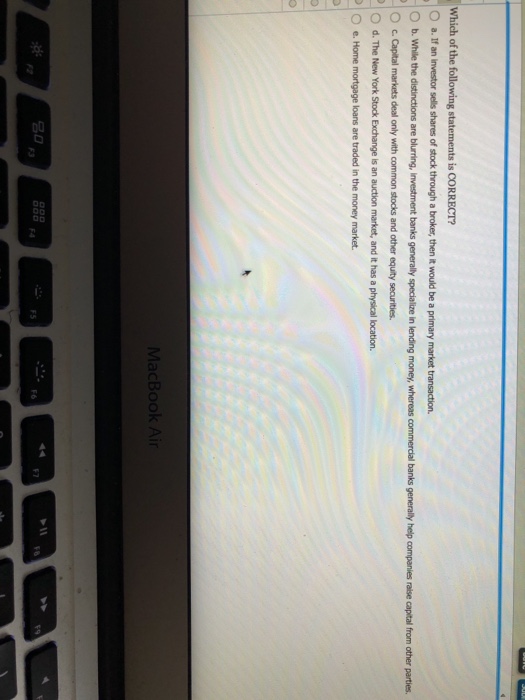

D to developing nations only. CIn the secondary market securities transactions cannot take place on an exchange. If an investor sells shares of stock through a broker then it would be a primary market transaction.

Capital market instruments include both long-term debt and common stocks. B to London banks. A capital market is a financial market in which long-term debt over a year or equity-backed securities are bought and sold in contrast to a money market where short-term debt is bought and sold.

The new York stock exchange is an auction market and it has a physical location. All the transactions that occur in connected markets across the economies of different countries. The international bond market consists of all bonds sold by issuing companies governments or other organizations ________.

All securities that are purchased in the open market c. C outside their own countries. This problem has been solved.

If General Electric were to issue new stock it would be considered a secondary market transaction since the company already has stock outstanding. -If an investor sells shares of stock through a broker then it would be a primary market transaction-The New York Stock Exchange is an auction market and it has a physical location-Home mortgage loans are traded in the money market-Capital markets deal only with common stocks and other equity securities. If your uncle in New York sold 100 shares of.

If General Electric were to issue new stock this year it would be considered a secondary market transaction since the company already has stock outstanding. A capital market provides individuals and firms with an avenue to raise funds for their needs and wants. The secondary market is where bonds and stocks are traded by investors.

Both Nasdaq dealers and NYSE specialists. What are the types of Capital Market. It is a part of the capital market where new securities are created and directly.

Capital markets are markets for buying and selling equity and debt instruments. Capital markets help channelise surplus funds from savers to institutions which then invest them into productive use. The NYSE does not exist as a physical location.

A any security that is purchased from a brokerage firm that is well capitalized B common stock of a public corporation C all securities that are purchased in the open market D US.

Cash Flow From Investing Activities Overview Example What S Included

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

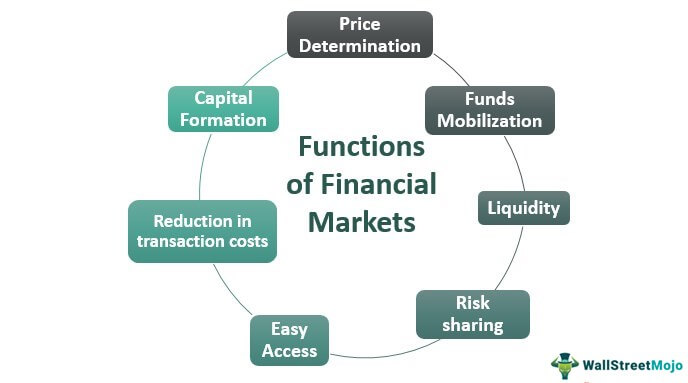

Functions Of Financial Markets List Of Top 7 Financial Market Functions

Chapter 2 The Financial Markets And Interest Rates Flashcards Quizlet

Accounting Ch 13 Flashcards Quizlet

Derivatives Flashcards Quizlet

Question Which Of The Following Statements Is Correct O A The Nyse Is An Example Of An Over The Counter Market O B As They Are Generally Defined Money Market Transactions Involve Debt Securities With Maturties Of Les Than One Year C If Disney

Acct 500 Msb Gu Flashcards Quizlet

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

Stockholders Equity Definition

Capital Market Line Definition Formula Calculation With Cml Examples

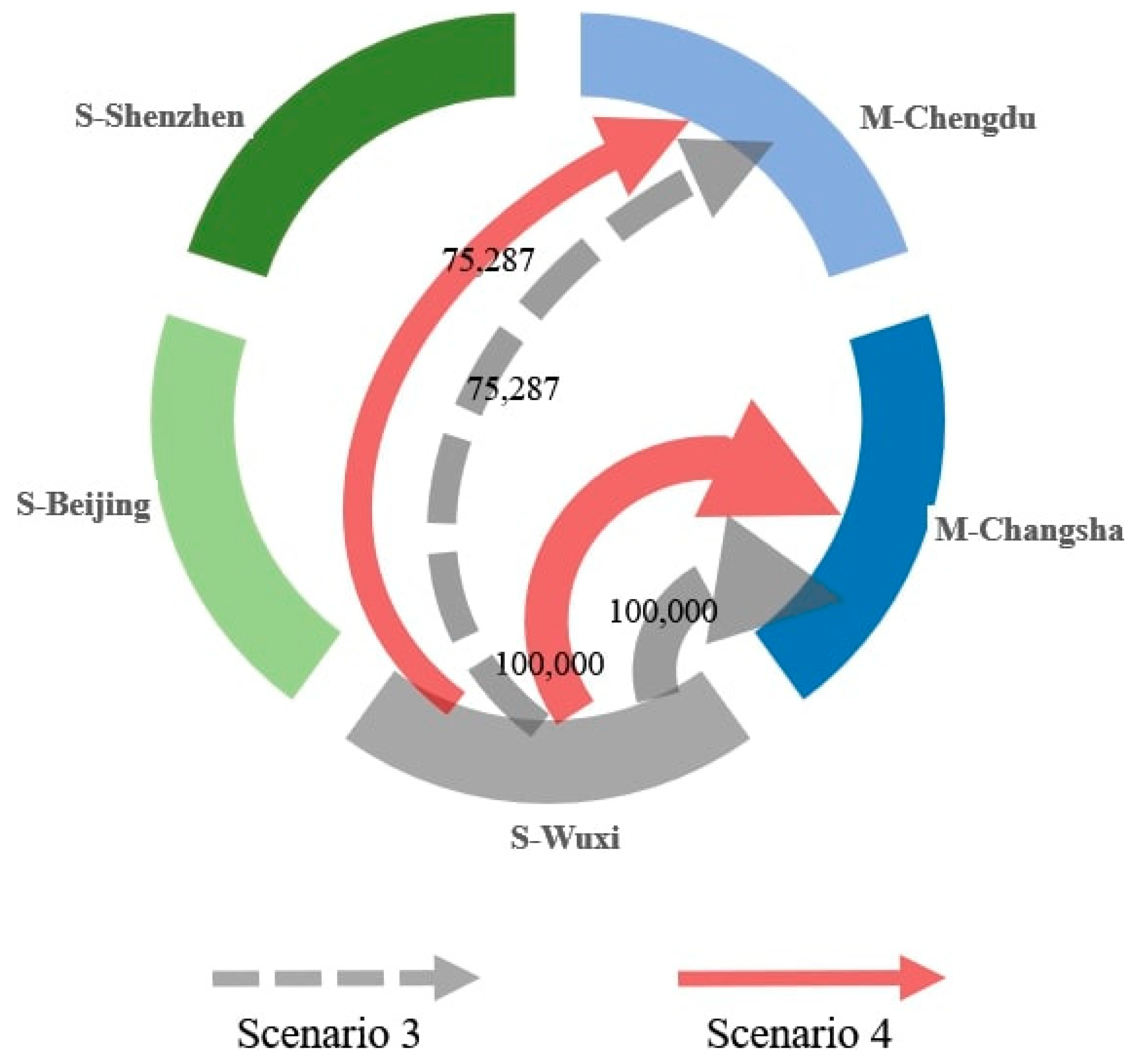

Ijerph Free Full Text Supplier Selection And Order Allocation Under A Carbon Emission Trading Scheme A Case Study From China Html

Fin 303 Ch 2 Financial Markets And Institiutions Flashcards Quizlet

Education Apps Market Recorded 29 98 Y O Y Growth Rate In 2021 Growing Demand For Stem Based Apps To Drive Growth 17000 Technavio Reports

Solved Which Of The Following Statements Is Correct O A Chegg Com

Primary Market Vs Secondary Market 10 Differences With Infographics

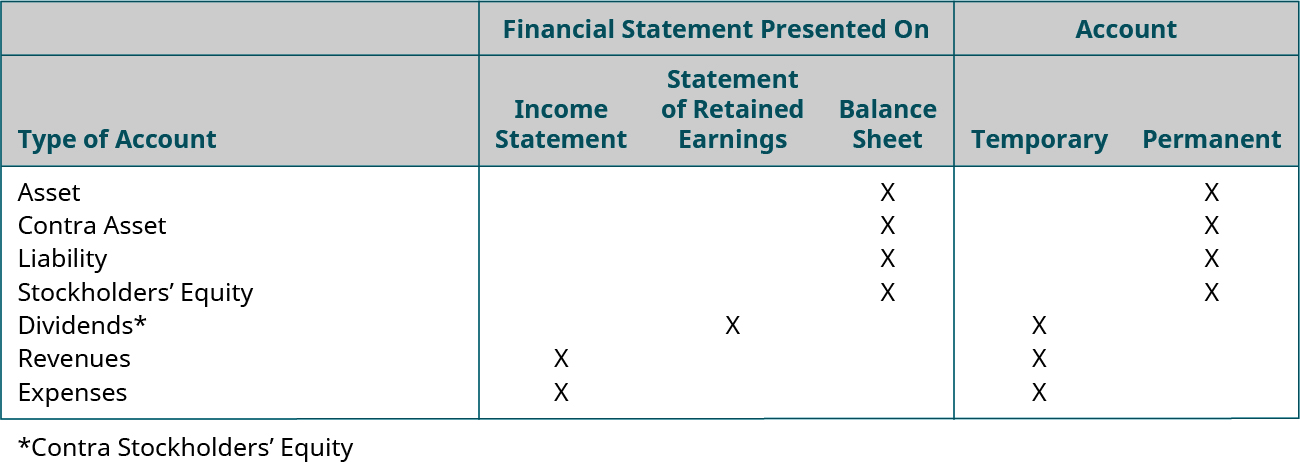

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Comments

Post a Comment